Wishing all my readers a happy new year! Thank you for your support in 2022!

In this issue:

BRIEF MACRO UPDATE

Stocks

Recession

Inflation

The Charts

PORTFOLIO DETAIL

Portfolio Objective

Asset Allocation

Current Holdings and Rationale

Composition Highlights

Recent Trades

Performance

ETF-only Portfolio Alternative

FOREWORD

I know that 2022 was an epic disaster for many investors and I feel very fortunate to have been positioned properly for the events that were to unfold. My portfolio was down less than 1% for the year and on a relative basis I will consider that a success.

I feel well-positioned for 2023 and I am writing today to share my thoughts going into the new year including a summary of my macro outlook, my detailed holdings and rationale for portfolio allocation.

I hope you enjoy reading this as much as I enjoyed writing it for you, and I hope you find great value here in terms of managing your own investments!

I do read and reply to all comments, so please ask questions and/or share your own perspective so we can keep the conversation going and learn from one another.

BRIEF MACRO UPDATE

STOCKS

As a new year kicks off for the stock markets we must always consider the “January Effect.” This effect is theorized to occur when investors sell losers in December for tax-loss harvesting, only to re-buy new positions in January. Because 2022 was such a big down year for most stocks, there is the potential this effect may be outsized this time around. If so, I will simply say ‘thank you’ and I’ll likely add to my short positions if we see a rally to start the year. The 2nd SPY chart below contains a speculative illustration as to the sort of move that may occur.

My base case is that US stock indexes will see lower lows before the current cyclical bear market is over; perhaps seeing a new leg down as early as Q1.23. However at some point in the year, on the back of what will eventually be a slightly more dovish Fed (maybe not lower rates, but a less-hawkish tone at least) and a potential washout of bullish sentiment, both stocks and commodities may begin a very strong multi-month cyclical bull market rally.

In fact, understanding the insanity of the masses, I would not rule out the possibility of higher highs in some of the US indexes before the next major cyclical bear market begins. We shall see.

Predicting the exact timing or strength of any market move is speculative at best. What is most important is knowing where we are in terms of the market cycle, and the SPY chart below illustrates my thoughts in that regard.

I believe we are still near the beginning of a multi-year secular bear market which will be characterized by extreme volatility in both directions, which may present many opportunities for the active investor, and is likely to frustrate the buy-and-hold crowd repeatedly.

Felix Zulauf calls the coming period a “Decade of Roller Coaster Markets”

As you will see below under Recent Trades I continue to add to my favorite stock positions, take gains in long-held positions and trade for better value, and continually adjust my short positions to offset volatility and take advantage of major pullbacks.

The bear market of 2022 has created a lot of value in some of the best stocks, and I continue to look for companies with strong balance sheets, steady cash flow, stable dividend and low forward-price-to-earnings ratio.

RECESSION

Right now my best guess is that we are in for a long recession, the depths of which may vary considerably from quarter to quarter. For now I am leaning toward a mild recession in the US in mid-2023, with a deeper and longer recession to begin sometime later in 2024, perhaps influenced by a return of inflation as noted below.

The central banks of the world are not in a position to start QE again, and in fact are not likely to lower interest rates in any meaningful way any time soon. I think it will take a significant amount of economic and market pain for such central bank action to begin — exactly when and how that works itself out will be discussed in future posts as we move along.

INFLATION & COMMODITY PRICES

I can see a new commodities bull cycle beginning later in 2023 with a less hawkish Fed, and lasting for a couple years or more. Such a new cycle of higher prices would likely begin due to a scarcity of supply rather than excess demand as we enter a period of a slowing economy. A sustained rise in commodity prices would likely kickoff the next inflationary cycle with treasury yields rising once again — in effect, a replay of 2021-2022 to some extent.

THE CHARTS

S&P 500: The broader US index is likely to move down to medium- and long-term support at some point during 2023-2024. Strongest support levels occur at the intersection of multiple support points. Therefore the slope of a move, up or down, greatly influences inflection points. I suspect the ~338 level of SPY will be hit in the first part of 2023.

US DOLLAR INDEX: As

reported on Dec 21, the Bank of Japan made a significant change to their monetary policy which immediately boosted the Yen 3% against the US dollar. For any currency, that is a very strong move and may add to continued weakness in the dollar for the longer term.In the short-term however, the DXY looks to be oversold and we are likely to see a bounce in Q1.23. Such a move would then coincide as expected with stocks moving lower as mentioned above.

EMERGING MARKETS: As I discussed in a previous post, there is generally an inverse correlation between the strength of the US dollar and emerging market asset prices. With the dollar having appreciated considerably over the past two years, there may soon be vast opportunities for outperformance among emerging market assets. The chart below is copied from my Nov 20 post.

WTI CRUDE OIL: After reaching a high of $130/bbl in early March following the start of the Russia-Ukraine conflict, oil has pulled back near its long-term mean making it more practical to add to positions in this sector. While a recession could certainly push oil below $60, I expect the midstream companies in my portfolio to remain relatively stable for the longer term.

GOLD: From

Nov 13:“For the medium- and long-term I’m therefore optimistic on gold. In the short-term gold still has downside risk due to rising interest rates and the possibility of collapsing asset markets triggering a liquidation event”

I am looking for an opportunity to add to my position in GLD, perhaps on a pullback to short-term support indicated in the chart below. I also hold a full position in Newmont Corporation (NEM), a major explorer of gold and silver.

US TREASURIES: The sustained rally in bond yields throughout 2022 has led to an opportunity to begin building a position in US Treasuries (TLT shown below).

BITCOIN: For those who follow Bitcoin, I am including a chart published by Gareth Soloway on Dec 21 noting that “BTC/USD likely needs to hit the downsloping trend line at least one more time before a bottom is in. This may coordinate with BTC around the 9k ish level.”

And with that, let’s dig into my Portfolio!

The below portion of this newsletter is still being offered free of charge to all my readers. Please see my About page for subscription tiers coming in March.

MY PORTFOLIO

I know some of my readers are experienced enough to translate the content of this newsletter into actionable steps for building and managing their own portfolio tailored to their needs. However I also know that some of you may lack proper experience and the last thing I want to do is mislead anyone. The information provided here is Intended to put my macro framework into context for the experienced investor and is not to be construed as investment advice for any specific individual.

PORTFOLIO OBJECTIVE

My portfolio is designed for a specific portion of my wealth and is constructed with a total return profile, seeking capital appreciation through both dividend income and growth. My portfolio has a very strong bias toward risk management and capital preservation with the goal of providing superior risk-adjusted returns.

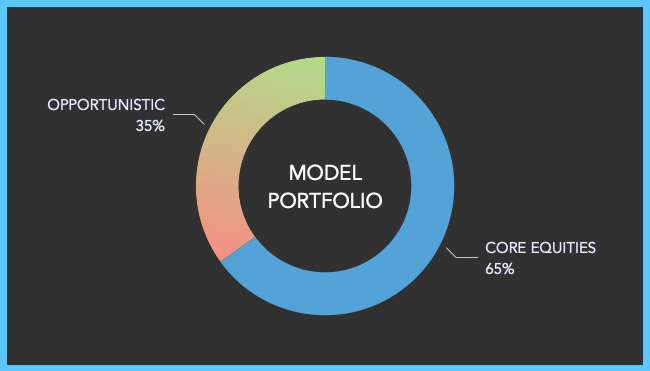

ASSET ALLOCATION

To better understand my model portfolio and investing approach, I encourage you to refer back to both my Introduction and Opportunistic Tranche articles.

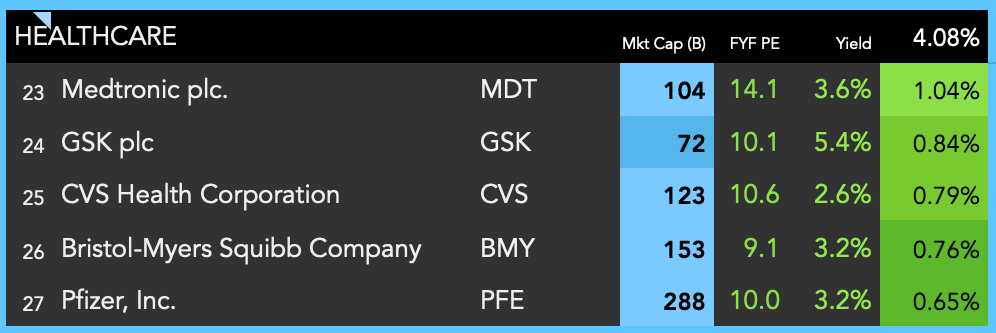

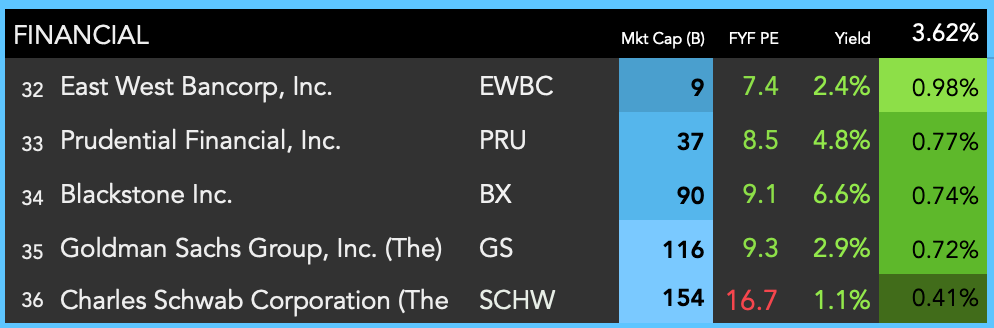

CURRENT HOLDINGS as of 12/30/22 pre-market

My current holdings are listed in the tables below. The right-most column shows position size as percent of total portfolio. My portfolio is actively managed, so any position you see here is subject to change at any moment and may not exist in my portfolio by the time you read this.

CORE EQUITIES

OPPORTUNISTIC TRANCHE

COMPOSITION HIGHLIGHTS

RECENT TRADES

With so many stocks having taken a significant beating over the past year, I am finding opportunities to begin building new positions while adding to existing positions on pullbacks. Over the past month, I have been taking long-term gains on overbought positions and replacing those with stocks at a better value. This allows me to increase my net-long exposure while keeping risk and volatility relatively low.

I increased both my long and short exposure in December as I prepare for the next major market move, in one direction or the other

Overall I increased my long exposure from 31% to 36% in December

I may add to my short positions should the indexes rise in January

Positions closed in the past month include MMP, AEP, PEP, SYY, PFG, EMXC, MRK, MCD

New positions added to replace closed positions include: MPLX, ET, BG, EWBC, CTSH, CRI, CAG, INGR

PERFORMANCE

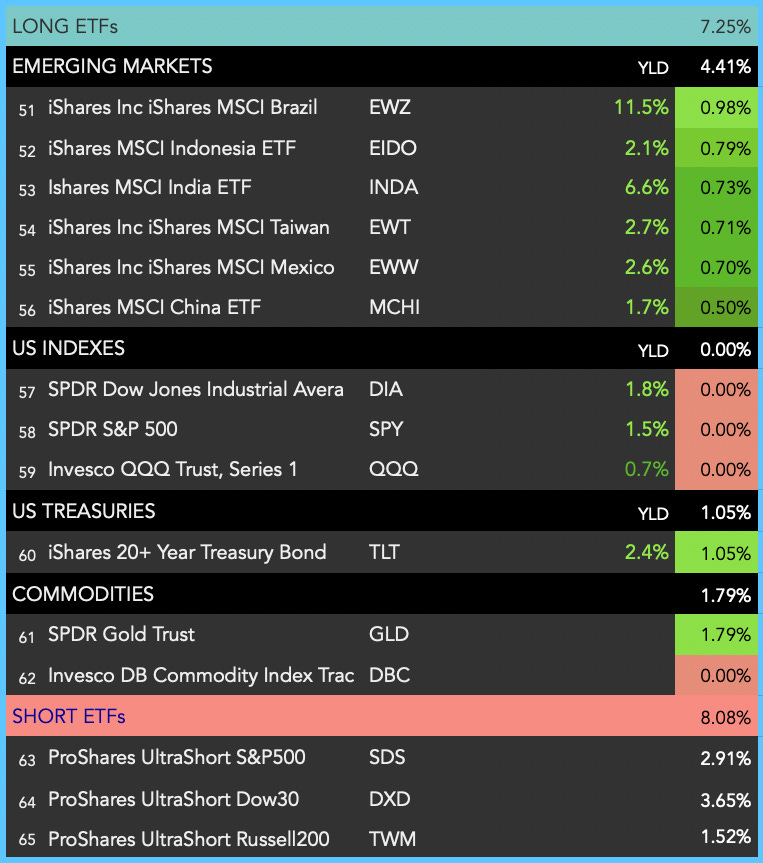

ETF-ONLY ALTERNATIVE

If your preference is to avoid individual stocks and build an all-ETF portfolio, that may work well for you also. There is a big world of ETFs available out there and I know many people who have successfully constructed excellent portfolios in this manner.

If you would like help to better understand the ETF landscape please either seek the advice of a professional of your choice and/or visit my About page to contact me for more information.

Below is one version of an ETF-only portfolio intended to be similar-in-spirit to my portfolio, but of course this is far from an exact replica of holdings. However, this portfolio does contain similar proportions of sector and asset allocations as well as similar net-long exposure.

IN CLOSING

If you have questions or would like to continue the discussion, please comment, join my free Chat or visit my About page to contact me directly.

Hi Sound-Speed, all great questions!

Stocks vs. Other: My portfolio is actually a mix of security types, but I generally hold 50 individual stocks in my Core Equities tranche, while using ETFs within my Opportunistic tranche allowing for easier broad coverage for things like emerging markets, US treasuries, commodities, inverse ETFs, and US index ETFs as appropriate. An all ETF portfolio works well also and I show an example of what that might look like in my article -- socks vs. ETFs is primarily a personal preference. In my case I seek higher dividend yield than ETFs generally provide in terms of a total portfolio. But either approach is good - what's more important is knowing how to vary exposure to risk assets given the market cycle, particularly at turning points.

Cash equivalents: Right now this is all cash for me, but I am looking into some money market funds for a portion of the case. With interest rates where they are, I see that Schwab, for example, has a couple money market funds paying near 4%. I may park a small portion of my cash there, leaving the majority of my cash available for adding securities on the next leg lower for the SP.500.

Security selection: I am thinking of writing a piece on this topic. In short, I begin with a screen for stocks that meet certain criteria for cash flow, sales growth, income growth, dividend yield, forward PE, and the like. Then I look at the charts to see which of those stocks are look to be at a good buy point - generally I build a position over time to the extent I can lower my cost basis.

For both fundamental and technical analysis, you might check out Finviz - their free product is great, but you can also pay a bit for access to their professional charting tools.

You might go back and read these two earlier posts of mine for some general guidance: https://finiche.substack.com/p/coming-soon

https://finiche.substack.com/p/2-portfolio-insights-opportunistic

I hope you find this helpful... let's keep the conversation going.

Cheers and Happy new year!

F.

Thank you for your thoughts. This was a great article to compare your portfolio against mine current portfolio.

It genuine that you have share your holdings with us and your reasoning behinds us. Extremely helpful. I am a new subscriber and looking forward to more of your writings.